Like most of us when I was fresh out of college and entering the job market as a young software engineer, I enrolled in the typical savings plans like 401(k)s, mutual funds, and ETFs. All of the experts said that these were the best and safety ways to grow and protect my nest egg until I was ready to retire.

However as I matured, got married and started a family of my own I soon realized that these plans were not designed to produce generational wealth. Furthermore facing potential over exposure to the stock market there was a significant risk that I may not even have enough to live comfortably after I decide to leave the work force.

Most financial planners suggest adopting the 4% rule. This rule states that you can comfortably withdraw 4% of your savings in your first year of retirement and adjust that amount for inflation for every subsequent year without risking running out of money for at least 30 years.

In a perfect world this should work but what happens if something unforeseen happens like….a Global Pandemic?

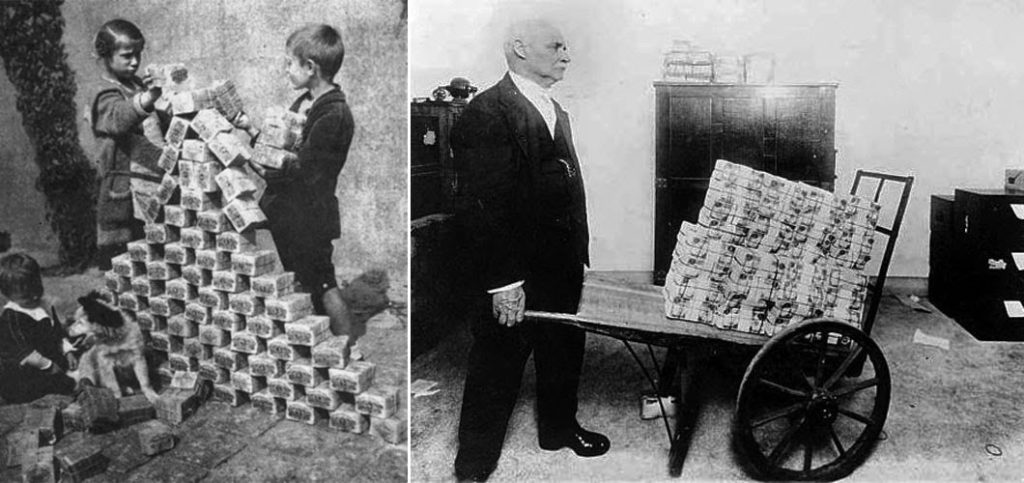

What happens when you 7% inflation instead of the 4% we were told to expect?

How typical savings plans can fail..

Most people are depending on the following income sources to secure their retirement.

- 401K Plan

- Bank saving account

- Social Security

Let’s take these one at a time and discuss how even having these 3 sources of income could still not be enough for a comfortable retirement.

401K Plan aka “The Personal Pension”

As you can see in the graph below the median 401K balance for individuals 65 years and older is $64,548.

While your 401K balance may differ this is stark reminder that most people’s primary source of retirement income will only last the average American in retirement about 3 years. Furthermore if the 4% rule is applied then that means a little over $2500 per year or $200 per month in income.

Good old savings account aka “Dead Money”

According to the FDIC, the national average interest rate on savings accounts currently stands at 0.04% APY. With Big banks often offering a 0.01% APY on their most basic savings accounts. Furthermore inflation is currently hovering around the 7% range, so your savings in the bank is actually losing value by the day…talk about “dead money“!!

Grant Cardone, the CEO of Cardone Captial one of the largest Multifamily syndication firms in the nation says:

“Cash is trash..put that money to work son!!“.

Social Security aka “Old-Age and Survivors Insurance”

As of May 2021, the average check is $1,430.73, according to the Social Security Administration. For years, experts have been warning that Social Security’s long-term financial outlook is bleak, and the program’s most recent Trustees Report, released in April 2020, confirms that. Specifically, that report projects that Social Security’s combined trust funds will run dry in 2035 unless payroll taxes are increase and/or benefits are reduced. Furthermore with inflation on the rise there will be an even greater likelihood of benefit reductions or the age to qualify for benefits will increase.

What can you do?

Daniel Ameduri in his book Don’t Save for Retirement gave us some of his best secrets for saving for the future and working your way to financial freedom. Daniel doesn’t suggest that folks quit their jobs; instead, they should take the money they would be putting away for when they retire and invest it into an asset that provides both cashflow and equity growth. With the goal to start with a small passive income through investments you can afford. Then keep putting your money back into it until you’re making enough to be financially free.

One such asset class that combines cashflow, equity growth and tax advantages due to deprecation is Multifamily real estate.

In our next newsletter we will discuss how investing passively in Multifamily real estate can greatly reduce the time required to reach financial freedom.

If you have questions about how to invest or want to learn more about our other investment opportunities please feel free to reach out to me at travis@freemanequity.com or feel free to schedule a quick Zoom meeting here.