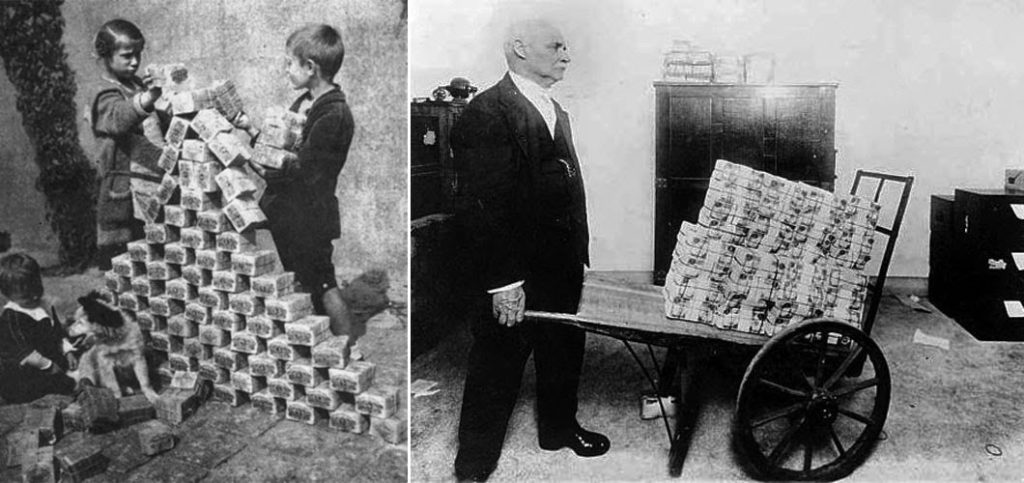

There’s no doubt we live in historic times. Even during a global pandemic over this past year, we are seeing a red hot housing market…especially in Multifamily Real Estate.

As such investors are eager to get into deals to take advantage of this unprecedented move in this historically stable asset class. Recently I have spoken with several investors who wanted to invest in more deals however they are in a very common situation.

They are “asset rich” but “cash poor”.

Meaning they have significant equity in other asset classes however they do not have the capital available to invest when great Multifamily real estate deals come along.

“Trapped” capital sources

Here are some examples of “trapped” capital that people often overlook:

-

Retirement Accounts(IRA/401K)

-

Home Equity

-

Stock portfolio(s)

Let’s take a look at these sources one at a time and discuss how to go about unlocking their “trapped” capital.

Retirement accounts(IRAs, 401k)

Retirement accounts are an often overlooked source of “trapped” capital. What most people don’t realize is that this doesn’t have to be an either-or dilemma: You can use both your 401k and individual retirement account (IRA) to invest in real estate. In addition, contrary to popular belief, you can do so without suffering from steep withdrawal penalties.

Typically this involves rolling an IRA(Traditional or Roth) or an old employer 401K into either a self-directed (aka Solo) IRA or 401K depending on your needs.

There are many different firms that you can use to set up your self-directed retirement plans.

However for those that are comfortable doing their own bookkeeping we recommend these two firms to our clients:

1.) Rocket Dollar (“Core” $360 set up and $180 per year or for “Gold Service” $600 set up and $360 per year)

2.) Solo 401K By Nabers Group ($399 set up and $99 per year)

Note: You generally cannot invest directly in real estate through your current employer’s 401k plan. However, depending on your circumstances there might be some ways for you to use the assets in your 401k accounts to make real estate investments. Furthermore, keep in mind that while investing in real estate from a tax-deferred account means you probably will not have an immediate tax liability on your capital gains. This also means that you may not be able to take advantage of the depreciation tax deductions either. Please consult your CPA or tax professional regarding your specific tax situation.

House(Refinance/HELOC)

Equity from your primary residence(or rentals) can be a great way to invest in Multifamily real estate. In most cases, you should consider the equity in your home to be comparable to cash in a saving account paying you the same interest as your mortgage interest. There are two approaches to unlocking capital “trapped” in your home’s equity and each with its pros and cons. Let’s take a look at each option.

Refinance

-

Borrow up to 100% of equity(depending on lender)

-

Lower interest rates

-

Higher fees for loan origination

HELOC(Home Equity Line of Credit)

-

Most affordable and fastest choice

-

Higher interest rates

-

Must remain in the property for a specific period.

Stock portfolio(Margin)

Let’s assume you have $400,000 in your company’s stock just sitting in your brokerage. You could sell a bunch of shares and trigger capital gains taxes (which depending on your tax bracket could cost you at least $60,000 in capital gains depending on your basis.

An alternative solution you should consider is obtaining a margin loan from your brokerage against the stock held. This will allow you to in effect borrow money against your own shares of stock, at an interest rate below two percent (1.5%), without selling any of them.

For investors that are considering a margin loan against their stock portfolio, we would highly recommend using Interactive Brokers. They have an unusually good Margin Loan capability and the lowest interest rates on the market.

Note: There are some market-related risks with the use of margin loans especially when portfolios are over-leveraged(more than 50% of total account value) so keep that in mind.

So what’s next?

Now that you have “unleashed” capital it’s time to start investing to generate monthly income or continue to build your retirement nest egg.

In fact, you maybe be able to reach your Financial Freedom number with this “unleashed” capital.

Check out our Passive Investor Financial Freedom Calculator to determine how close you actually are to that lofty goal. Feel free to adjust the values to see how it impacts your Financial Freedom timeline.

If have any questions about the concepts mentioned above or you would be interested in becoming a passive investor for one of our upcoming deals feel free to schedule a quick Zoom meeting here or reach out to me at travis@freemanequity.com